Purchase discounts and allowances

Businesses use discounts and allowances to encourage customers to buy from them or to pay an outstanding bill sooner. Incentives used to motivate sales are called discounts while those used to motivate payments are called allowances (which apply only to purchases made on credit).

Discounts are most often used by retail and wholesale companies (e.g., when a store holds a 10% off sale).

An example of an allowance would be to offer a 2% discount on a bill paid in 10 days but no discount for paying in 30 days.

When a company provides a discount or an allowance to a customer it appears on a company’s income statement as a reduction to revenue. This means the net revenue figure is the “true” revenue for the specified period.

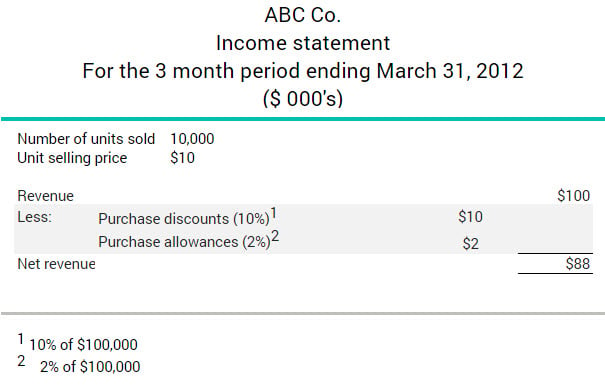

More about purchase discounts and allowances

The excerpt below shows how purchase discounts and allowances are deducted from gross revenue on the income statement of a retail or wholesale company. In this case, ABC Company sells 10,000 units of its product at $10 each, with a 10% purchase discount and a 2% purchase allowance for customers.