Variable costs

Variable costs are the expenses a business incurs that change with the amount of goods produced or services provided.

More specifically, when production or sales increase, variable costs increase, and when production or sales decrease, variable costs decrease.

“It’s important for business owners to understand the dynamics driving their variable costs. That helps them to price their products or services appropriately and stay competitive,” explains Beth Fisher, Senior Business Advisor, BDC Advisory Services.

Examples of variable costs

Variable costs include an array of expenses such as:

- raw materials

- supplies

- direct labour

- utilities

- commissions

- credit card fees

- packaging

- distribution

What are the most common variable expenses?

The four most common variable costs are:

- direct labour

- raw materials and supplies

- packaging

- distribution

However, common variable costs may differ depending on the industry:

- In a manufacturing company, for example, the main variable costs are usually direct labour and raw materials.

- In a services company, the main variable costs are usually direct labour, supplies, and materials needed to provide the service.

How to find your variable costs

In a manufacturing company, the variable costs will normally all be listed on the bill of materials (BOM), which is a list of the items needed to produce a product.

In a company providing a service, the variable costs will usually be clearly listed on the job quote.

Where do variable costs appear on a company’s income statement?

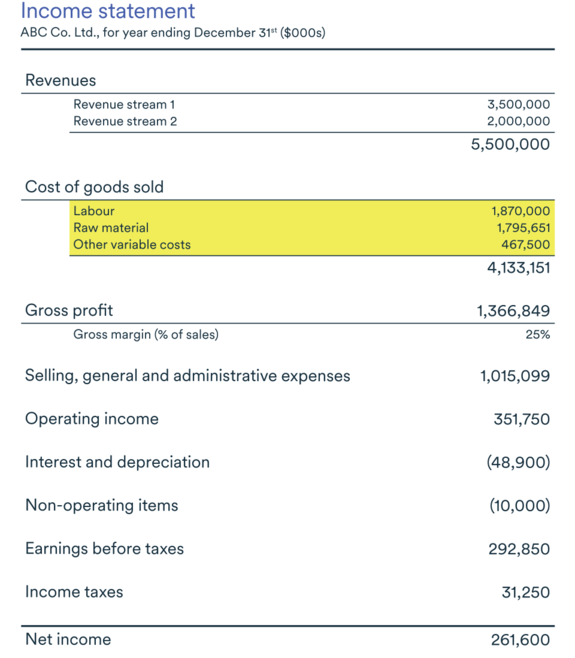

Variable costs generally appear on an income statement under cost of goods sold (COGS) or cost of sales, as highlighted in the image below.

Calculating variable costs

Below are three methods to calculate different types of variable costs.

1. Variable cost

The variable cost is the quantity of output multiplied by the variable cost per unit of output. Here is the formula:

Variable cost = Total quantity of output × Variable cost per unit of output

2. Variable cost per unit

The variable cost per unit is calculated by dividing the variable cost by the number of units produced. Here is the formula:

3. Total variable cost

The total variable cost is the sum of all variable costs incurred to produce a good or provide a service. Below are two examples:

- Service sector

For a plumbing services company, the total variable cost would include the plumber’s direct labour, fuel for their vehicle, and supplies consumed for the job such as piping, faucets, shower units and caulking. - Manufacturing sector

For a cake manufacturer, the variable costs would include baking ingredients, such as flour, eggs, milk, chocolate, sugar and paper liners for the cake pans, plus the baker’s direct labour expenses, as well as the electricity used for the oven.

Below is a numerical example showing how to calculate the total variable cost as well as the variable cost per unit for a fictional cupcake company. The costs are listed on the firm’s bill of materials.

Why calculate variable costs?

Calculating variable costs will help you understand which expenses are driving your total costs and help you establish a pricing approach that works for your business.

“Business owners need to price their products based on the changes in variable costs,” says Fisher. Since a company can adjust its variable costs, it can react quickly if it is experiencing cash flow issues. In this case, management may decide to alter production, so the company does not incur these costs.

Knowing your variable costs can also help you in your planning and budgeting: If your company is preparing to scale up its production, being aware of your variable costs will help you figure out how your total costs would change if you were to increase production or sales by a given amount.

How do fixed costs differ from variable costs?

Variable costs are one of three types of costs incurred by most businesses. The other two are fixed costs and semi-variable costs.

Below are a few examples of each of these three types of costs:

Fixed costs

- rent

- salaries

- insurance

- property taxes

- interest

Variable costs

- raw materials and supplies

- direct labour

- utilities

- commissions

- credit card fees

- packaging

- distribution

Semi-variable costs

- repairs and maintenance

- phone

- electricity

- vehicle

- Internet

- payroll

- employee compensation

Fixed costs differ from variable costs in that, generally, fixed costs will not change, regardless of volume fluctuations or the amount of goods produced or services provided.

“Total variable costs, on the other hand, will change with volume fluctuations or the amount of goods produced or services provided,” explains Fisher. “They rise when sales and production go up and fall when sales and production volume go down.”

Finally, as their name suggests, semi-variable costs may, or may not, change with the amount of goods produced or services provided.

These three types of costs, variable, semi-variable and fixed, also differ in the way they appear on a company’s income statement.

- Variable costs normally fall within the category of costs of goods sold or costs of sales.

- Semi-variable and fixed costs appear together on a company’s income statement as operating expenses.

Next step

Discover how to analyze your business’s financial information by downloading the free BDC guide: Build a More Profitable Business.